What Could I Do With A Personal Loan?

Although personal loans can cover almost any expense, some lenders have restrictions on how they can be applied. Unlike loans for homes, cars, or colleges, which can only be used for one purpose, personal loans can be used for various purposes.

One possibility is to use a personal loan for:

- Consolidating debt,

- making home improvements,

- purchasing numerous items,

- planning a wedding or vacation,

- receiving infertility treatment,

- or adopting a child.

How Much Interest Should I Anticipate?

Comparing pre-qualified rates from various lenders is a good idea because each evaluates borrowers and sets rates differently. Most short-term loans have lower interest rates, and if your credit score and report are strong, your rate will be even lower. Over time, a low-interest loan can help you save money.

Many lenders will offer you a discount if you agree to have your monthly loan payments deducted automatically from your bank account.

A lender will offer you the best rates if you submit an online application, have a high credit score, and consent to the loan conditions. Comparison of loan offers, terms, costs, monthly payments, and repayment plans is made simple by PaydayChampion.

For A Personal Loan, What Credit Score Am I Required To Have?

Although different lenders have different minimum credit score requirements, the best rates on personal loans of PaydayChampion are available to borrowers with good to excellent credit. You will pay less interest if you have good credit than the average person.

Following are the typical credit score ranges and how they may impact your interest rates:

Less than or equal to the median (639):

If your credit score is in this range, it might be challenging for you to obtain a personal loan. If you want to get the loan, you should find a co-signer. If approved for the loan, you can anticipate paying a high-interest rate.

Fair (640–699):

While many lenders will grant personal loans to borrowers with average credit, you should anticipate paying a higher interest rate. A cosigner can help you get a better interest rate even if you qualify for a loan without one.

Excellent (700–749):

Your chances of getting a personal loan increase if your credit score is high. You’re also more likely to receive better rates. Although you are not required to have a cosigner to get a loan, having one may help you get the best rates.

Outstanding (at least 750):

You can qualify for most personal loans with the lowest interest rates if your credit score is at least 750.

How Does One Apply For A Personal Loan?

Each lender has a different set of criteria for who is eligible to apply for a personal loan. Here are a few of the most typical:

Good or excellent credit: Lenders prefer to work with borrowers with this type of credit. People with bad or fair credit can also get personal loans from several lenders. But remember that these loans typically have higher interest rates than those with good credit.

Verified income Lenders examine loan applications to determine borrowers’ ability to repay loans. You’ll likely need to provide proof of income in either situation, though some lenders have minimum income requirements while others don’t.

Low debt-to-income ratio: The debt-to-income (DTI) ratio measures how much your income is spent on monthly debt payments. A DTI ratio of 40% or less is typically needed to qualify for a personal loan, though some lenders may have lower requirements.

How Can I Get A Loan For Myself?

To obtain a personal loan, take the following four actions:

Please find out the names of the lenders and contrast them.

To find the best loan for you, compare as many lenders as possible. Consider the terms of the loan, any fees the lender may impose, and any requirements you must meet in addition to the interest rates.

Pick a loan type.

Choose the best loan option for your needs after examining various lenders’ offers.

Send the completed form in.

Once you’ve decided on a lender, you’ll need to complete an application and send any necessary paperwork, like tax returns or pay stubs.

Grab the money.

The lender will ask you to sign for the loan before giving you the money. A personal loan funds typically within a week of an applicant’s approval, but some lenders fund loans the same or the following business day.

What Justifies Obtaining A Personal Loan?

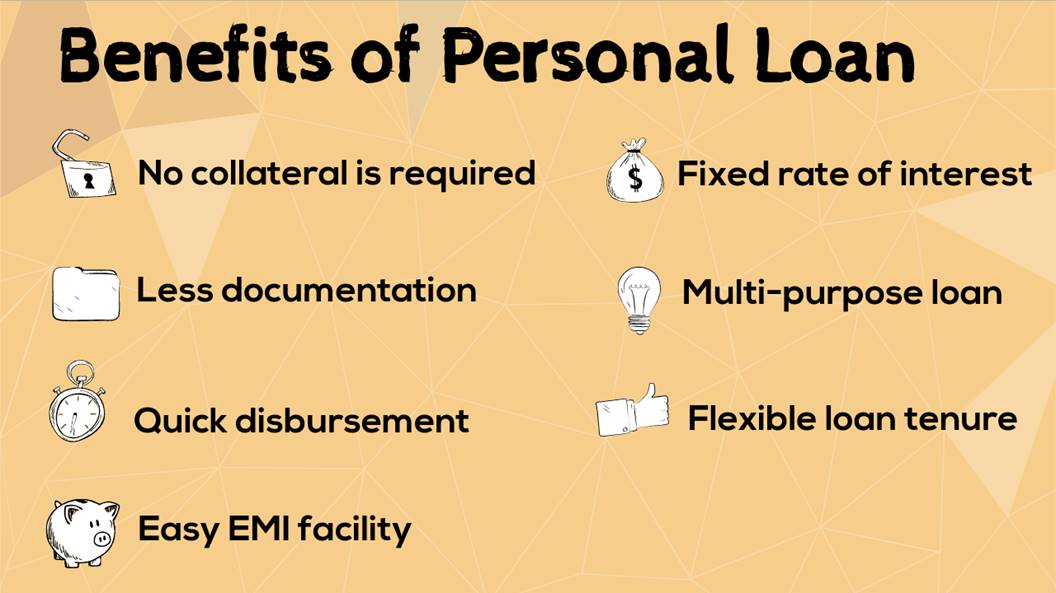

Personal loans have a lot of advantages, including:

- Most personal loans have fixed interest rates, so your rate and payment won’t change throughout the loan. These rates are frequently less expensive than those for items like credit cards.

- You can settle more than one debt at once: A personal loan can be used to determine multiple debts, including credit card debt and other loans. Depending on how good your credit is, you might be eligible for a lower interest rate than you’ve been paying, which could help you pay off your debt more quickly.

- Pay off large expenses: A personal loan can provide the funding required to cover costs such as home renovations, medical fees, or a wedding.

- You don’t have to worry about that because most personal loans don’t require you to put anything up as collateral. However, getting an unsecured personal loan could be more difficult than getting a secured loan because unsecured loans are riskier for the lender.

How Long Does It Take For A Personal Loan To Be Funded?

Each lender sets a different waiting period before disbursing a personal loan. A traditional bank might require you to apply in person, but an online lender will let you submit an application and receive a response immediately.

Depending on the lender, personal loans can take a while to fund. Here are a few of the most typical methods for receiving money:

- Web-based lenders

- less than five days of work

- seven working days and seven credit unions

From 7 a.m. to 7 p.m., some lenders provide personal loans that can be quickly processed and repaid. For instance, a few of PaydayChampion’s lending partners offer personal loans that can be refunded the same day or the day after. To avoid delays and receive your money as soon as possible, you must:

- Try your best to complete the application.

- Send in all the paperwork on time.

How Can I Obtain A Personal Loan? How Can I Show My Worth?

When you apply for a personal loan, you should be ready to provide documentation. The lender may request various loan documents, depending on your circumstances, but they may also include the following:

You were identifying identification, such as a government-issued ID or a Social Security card. You can demonstrate your ability to repay the loan by displaying tax returns or pay stubs. Statements from your bank indicating your income

How Much Credit Am I Eligible For?

There is a minimum loan amount and a maximum loan amount set by each lender. One of PaydayChampion’s affiliated lenders offers personal loans ranging from $600 to $100,000. Remember that your credit score will affect how much you can borrow. It would be best if you typically had good to great credit to qualify for the largest loans. To be eligible for a larger loan, you might need a cosigner if you need good credit.

How Much Time Do You Have To Repay A Loan?

Your loan’s repayment term is the amount of time you must make regular monthly payments (your loan agreement will outline your repayment term). Depending on the lender, you might have from one to seven years to repay a personal loan.

The cost of your loan will depend on how long it takes you to pay it back. For instance, choosing a long-term personal loan will likely result in lower monthly payments but higher interest costs overall. The shortest loan term you can afford should be selected if you want to save as much money as possible on interest.