TurboTax’s newest taxcaster feature is a simple one-step solution for your TurboTax filing. It lets you import up to five years of information into a simple spreadsheet easily, which you can then use for more customized calculations and more accurate estimates for your taxes. If you’re not sure what the taxcaster feature does, here are some of the ways it can help make your life easier when filing your taxes.

What is this TurboTax Taxcaster?

TurboTax Taxcaster is a unique feature that can help you save time and money when filing your taxes. The Taxcaster uses artificial intelligence to analyze your deductions and tax credits and provides a suggested refund or tax savings amount. The Taxcaster also provides tips on how to improve your tax return. lost your W2 form

To use the Taxcaster, first enter all of your information into the computer program. It will then suggest changes to your return based on its analysis of your information. If you have questions about the Taxcaster’s suggestions, you can contact customer service for more information.

The TurboTax Taxcaster is an excellent way to make sure your taxes are done correctly and quickly. If you have not used the Taxactor before, it is worth giving it a try this year – especially if you have filed in previous years using other software programs.

Why do I need it?

TurboTax Taxcaster is a tool that can help you save time and money when filing your taxes. TurboTax Taxcaster automates some of the more tedious tax filing tasks, like calculating your refund or adjusting your tax withholdings.

One of the Taxcaster’s most useful features is its ability to calculate federal and state taxes using information from your W-2 and 1099 forms. This can save you time and hassle by letting TurboTax automatically adjust your taxes based on your income and deductions.

If you itemize your deductions, TurboTax Taxcaster can also help you claim as many of them as possible. The program includes a deduction estimator that can help you find out how much you could deduct based on your specific situation. filemytaxesonline.org

The TurboTax Taxcaster is a valuable tool that can make tax filing easier and faster. If you don’t use it, consider adding it to your 2018 tax preparation plan!

How to use a TurboTax Taxcaster

TurboTax Taxcaster is a great way to get an accurate refund and save time during your tax filing. It’s a little-known feature you should definitely check out.

First, you need to create an account with TurboTax. You can do this by going to turbotax.com and clicking on the “create account” button. Once you have created your account, you will need to enter your personal information, including your name, address, and Social Security number.

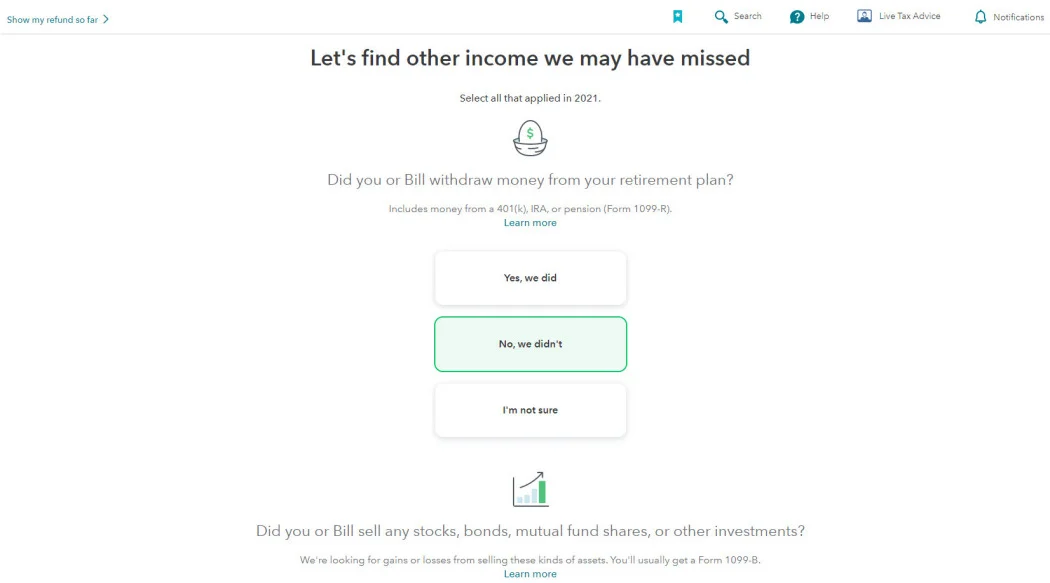

Once you have entered all of your personal information, it’s time to start filling out your tax forms. The first thing you will want to do is select the type of return you are filing: individual or married filing joint. Next, select the year in which you would like to file your taxes. TurboTax will then ask you for some additional information, such as your income and deductions.

Once you have completed all of the steps in the Tax Preparation Wizard, it is time to enter your credits and deductions. TurboTax will ask you a series of questions about specific items that may qualify for a deduction or credit. For example, if you are claiming itemized deductions on your return, TurboTax will ask about specific expenses that may be deductible.

Once you have entered all of the information required by TurboTax, it is time to fill out the final sections of the form: W-2s and 1099s If applicable (and depending on

Who should use this TurboTax Taxcaster?

TurboTax Taxcaster is a great way to save time and avoid mistakes when filing your taxes. If you use TurboTax, you should definitely check out the taxcaster! The taxcaster can help you save time by highlighting deductions and credits that you may be eligible for. The taxcaster can also help you find errors in your return, which can save you money on taxes.

Conclusion

TurboTax is known for its user-friendly tax preparation software, but did you know that the Taxcaster feature is also quite helpful? The Taxcaster allows you to input your expenses and see how much money you can save on your taxes by claiming certain deductions. This feature is not available through all TurboTax versions, so make sure to check it out if it’s offered in your version of the software.