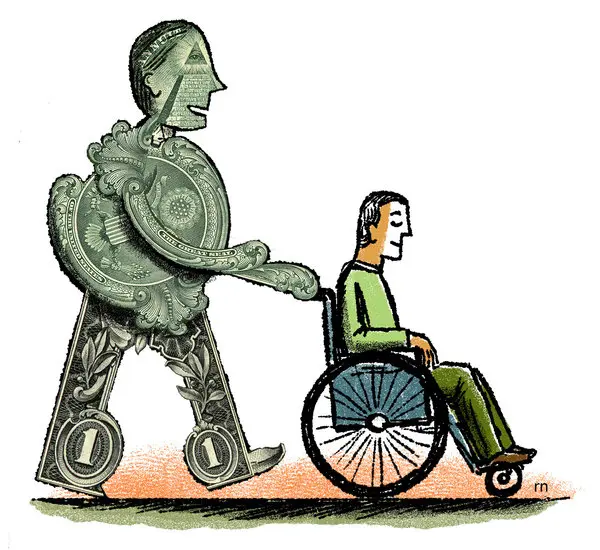

One of the most important things to remember when investing in disability insurance is that you are buying it to cover any disruption in your ability to work and earn an income. Now, what about a situation where you are not going to work to earn a livelihood? Such a situation can come in your life when you are not working to earn a wage, or you are retiring or you have inherited substantial wealth that needs different kinds of insurance cover. The basic idea here is that your disability concerns have changed and your income no longer needs the kind of protection that this particular insurance provides. In such situations, you can decide to drop the insurance and save the money you would pay as premium.

You have inherited huge wealth

It has happened with many people including those doing SEO in Islandia, NY and it can happen with you too – you could land a windfall and have so much money that you do not need to work and earn a wage any longer. You cannot overlook all the disability stories that you have heard but you don’t require the coverage in your new situation.

Speak to your broker advisor or if you had bought the policy on your own without the help of a broker, then just speak to the insurance provider and discontinue the policy. Just make sure that you are not required to pay any charges to drop the policy. Your objective is not to pay the premium anymore.

You have retired and will live off your pension

If you have had a good career working in a marketing agency in Ohio and have saved a neat pile in smart investments and pension plans, that will make for a fulfilling and happy retirement. In that case, you don’t need any insurance to cover your income. You are not working to earn this income; you have already worked hard and earned it.

Therefore, if there is any disability, your income stream is not going to get affected because you are not working to earn anymore. You don’t have to worry much about disability news stories in relation to your own risk of getting disabled and not able to work and earn an income.

Your income and savings have become substantial

It could be that you have hit the big time and are in a different league altogether, where your income has touched 7-8 figures. At this level, reading disability articles out of anxiety for covering your income in the event of disability would be a waste of your time. You are now earning thousands by the hour.

There is simply no need for you to think about replacing your current income with what a disability insurance policy will offer as a benefit. That would be just too little to meet your needs and you would anyway cover that with a fraction of the wealth you have accumulated. If you have a broker agent advisor insisting that you continue with the policy, politely explain to him/her that you don’t need it anymore.

Disability insurance is not for the rich and wealthy sitting on loads of cash and living the good life. It is for the person on the street, earning a wage and trying hard to improve his/her financial condition. Techcrams