To get started with your MyIndigoCard account, login here. You can also read about the annual fee, Credit limit, and Balance transfer facility. Once you have logged in, you can easily manage your account and make payments online. In addition, you can also contact MyIndigoCard customer support if you need help. If you are unsure of the process, don’t worry, we’ll walk you through it step-by-step.

Login to MyIndigoCard

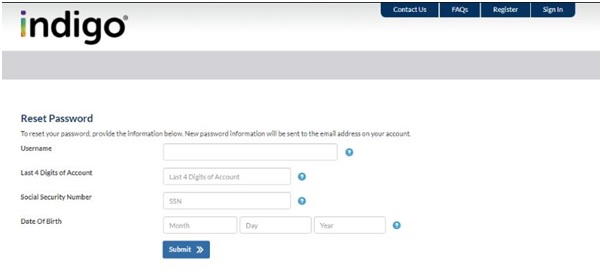

If you want to access your credit card account information, it is important to know how to login to My IndigoCard. This secure and convenient login process requires your user ID and password. Your user name and password should be unique, so that you can keep your account secure. If you are not able to remember your username and password, you can contact IndigoCard customer service. Customer service representatives will provide you with the necessary information, including your personal information and financial account details. You can even contact customer service if you need to reset your account password.

During the first year of your account, you will not be charged for cash advance activity fees. After that, you’ll pay late interest based on your average monthly prepaid balance, not the shortest time period. Your late interest fees will be calculated by using the below-listed periodic cyclic rate. However, this service is free, so it’s worth trying. You may also want to sign up for MyIndigoCard to get customer support and other benefits. Visit, Angel Investing.

Annual fee

If you’re looking for a credit card that will work with your bad credit, Myindigocard is the way to go. Because the company doesn’t pre-qualify applicants, you can apply without a credit check and start building your credit history again. This card also charges a low 1% foreign transaction fee, reports to all three major credit bureaus, and is widely accepted as a payment method.

The only downside to this card is its high annual interest rate. While this is generally within the range of a poor credit applicant, it is too high to be a good option if you plan to carry a balance. Because of the high-interest rate, you’ll use more of your credit limit, and this lowers your credit score. You’ll also have to pay an annual fee of $75 if you’re a new cardholder.

Credit limit

The first thing you should know about your Indigo credit card is its credit limit. Although there is no fixed limit, you may be eligible for an increase if your spending habits improve. As an added bonus, your credit limit is up to $300. You can use your card to pay for everyday items or to buy a new TV. However, be aware that late payments can hurt your credit score. If you are paying late on your card payments, you may find yourself being penalized by up to 100 points.

One option is to use an AI-powered legal service app. This can help you submit your request to increase your limit on your Indigo card. The app will help you avoid hard inquiries, which happen when you apply for new credit lines. Hard inquiries are a red flag because they mean a creditor has requested your credit report. If you’ve already applied for a credit card with Indigo, you might have a hard inquiry.

Balance transfer facility

If you are in the market for a credit card, you should consider My Indigo Card. This card can help you streamline top-up transactions. You can use this facility on regular banking days, as well as on non-banking days. As long as you’re aware of the strengths and weaknesses of MyIndigoCard, it’s a great option for most consumers. Its features are straightforward, but you should recognize the pros and cons of MyIndigoCard before you sign up for it.

Before you start using this service, you should know that it will incur a fee if you don’t pay your balance off in full. You can avoid this fee by making your payments on time and following the terms of your card. In addition, you’ll want to make sure that your monthly minimum payment is up to date. You should also be aware of any other fees that may apply to your balance. These fees include late penalty fees, overlimit fees, and returned payment fees.