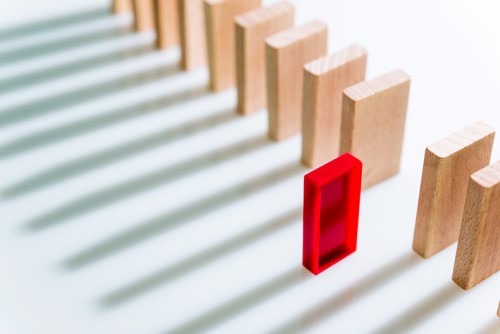

The geopolitical threat landscape is more volatile and diverse than ever in decades. This volatile geopolitical context can pose a threat to global businesses, assets, as well as people. Many companies consider taking out insurance against political risks to limit their exposure.

Political Risk Insurance covers the risk of losing commercial assets, income, and property in the event of a political threat. The policies can be used to cover a wide variety of risks, such as expropriation (or currency inconvertibility), contract frustration, non-payment, and political violence. Political risks are difficult and sometimes impossible to predict. If they do occur, the potential loss of income or assets can be severe.

Political Exposures

Emerging Countries

Multinational corporations have many opportunities in emerging market markets to grow and hold a dominant market share. Emerging markets present more risks than developed ones. Political instability, foreign government actions, and other socioeconomic factors can lead to asset value declines or even, in the worst scenario, can result in assets being destroyed or confiscated. Businesses might be reluctant to take advantage of emerging markets if there is no policy to cover the political risk.

Foreign government actions as well as socioeconomic events could create a hostile business environment that prevents foreign investors, exporters, or lenders from taking advantage of emerging market opportunities. This policy provides protection against loss of income, assets, or property by lenders and investors in emerging markets.

Who Is Eligible To Purchase Political Risk Insurance?

Multinational corporations and foreign investors can buy insurance covering political risks.

There are several ways that you can manage political risk.

1) Avoiding Investment:

Avoiding investments in countries rated high on political risks is the best method to manage these risks. Plants that have already been invested may be liquidated or transferred to another country that is more secure.

2) Adaptation:

Another way to manage political risk can be adaptation. Adaptation can be described as incorporating risk into your business strategies. MNCs manage risk through three strategies: development assistance, local equity and debt, and insurance.

3) Threat:

A way to manage political risk is to show the host nation that it can’t do without the activities or the firm. This could include trying to control technology, raw materials, and distribution channels in a host country. The firm might threaten the host to cut off the supply of its products and technologies if its operations are disrupted.

4) Lobbying:

The other way to manage risk is through lobbying. Lobbying is the act of hiring people who will represent the company’s interests as well as its views regarding local political matters. Lobbyists visit local officials to influence their views on firm-relevant issues. Their ultimate goal, however, is to get favorable legislation passed or rejected.

5) Invaluable Condition:

For companies that have access only to high-tech products or technology, it’s an effective strategy to attain the status of indispensability. These companies not only keep their politically vulnerable affiliates out of research and development but also enhance their bargaining position with the host governments by emphasizing how they contribute to the economy.

6) Vertical Integrity:

Companies with multiple plants are more likely to be dependent on each other than firms that have all their own plants. Distributed sourcing allows a firm to provide economies of scale for local operations. This strategy could be critical to the success of many industries.