In math, every digit in various has a place value. Location cost can be described because the price represented by means of a digit in more than a few on the premise of its role in the range. For example, the area price of seven in 3,743 is 7 masses or 700. But, the region price of 7 in 7,432 is 7 thousands or 7,000. Right here, we are able to see that despite the fact that the digits are equal in each the numbers, it’s region cost changes with the alternate in it’s function.

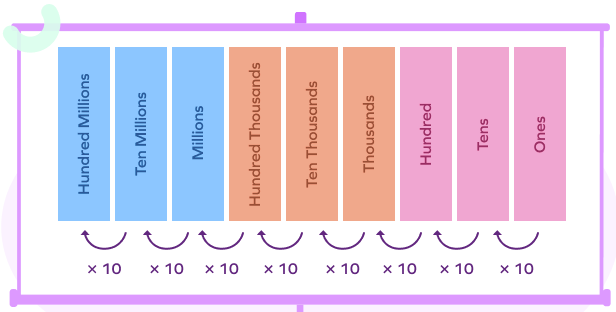

Place Value Chart:

Place value chart is a very useful table format that allows us in locating the area cost of each digit primarily based on it’s position in a number of. The vicinity value of a digit will increase by way of ten times as we pass left at the region fee chart and reduces by way of ten instances as we flow proper. Face value and Place value in hindi.

Right here’s an example of how drawing the location price chart can help in finding the place value of quite a number.

Within the number 13,548

1 is inside the ten lots region and has a place fee of 10,000.

Three is inside the thousands location and has an area cost of 3,000.

Five is inside the masses and has a place value of 500.

4 is inside the tens region and has an area fee of forty.

8 is inside the ones region and has a place fee of eight.

Information the location cost of digits in numbers facilitates evaluating numbers. It additionally allows in writing numbers of their expanded shape. As an example, the expanded shape of the variety above, 13,548 is 10,000 + three,000 + 500 + forty + 8.

What Is Face Value?

Face value is a economic term used to explain the nominal or dollar price of a protection, as said by using its company. For stocks, the face cost is the unique fee of the inventory, as indexed at the certificates. For bonds, it’s miles the quantity paid to the holder at maturity, commonly in $1,000 denominations. The face price of bonds is regularly called “par price” or actually “par.”

Understanding Face Value:

In bond making an investment, face price (par cost) is the amount paid to a bondholder at the adulthood date, so long as the bond provider would not default. But, bonds sold at the secondary market range with interest rates. As an example, if interest charges are higher than the bond’s coupon charge, then the bond is bought at a reduction (beneath par). Conversely, if hobby charges are lower than the bond’s coupon price, the bond is sold at a premium (above par). At the same time as the face cost of a bond provides for a guaranteed go back, the face value of a inventory is typically a poor indicator of real really worth.