Vietnam has more than 4 million game players, two thirds of whom are between the ages of 18 and 30. In Vietnam, up to 68% of Vietnamese play games on mobile devices every day, which provides a vast user market. However, in recent years, Vietnam has also introduced a version number policy similar to that in China, which has become increasingly strict, making it difficult for Vietnamese local publishers to obtain a version number. Although the local demand is strong, Vietnam’s game companies tend to expand overseas, actively expand the market and diversify their products to maintain the growth momentum.

The total population of Vietnam averaged 98.26 million throughout the year, and the number of game users exceeded 30 million, accounting for about 35% of the total population. By the second quarter of 2015, Vietnam had accounted for 37% of the mobile game market share in Southeast Asia, with a total revenue of $83 million, 1.5 times that of Thailand, and equal to the total mobile game revenue of Indonesia, Malaysia, the Philippines, and Singapore. In 2021, the total number of mobile game downloads in Southeast Asia exceeded 8.41 billion, and the number of game downloads in Vietnam was only second to Indonesia, which ranked first.

Mobile Gaming Market Status quo in Vietnam

According to the data of market research company Niko Partners and Google, Vietnam’s e-sports market will achieve a five-year annual growth rate (CAGR) of 28%, which will also be the highest in Southeast Asia. In 2020, Vietnam’s online game revenue will reach 10.1 million US dollars, an increase of 16% over 2019. In 2021, Vietnam’s mobile game revenue increased by 19.9% year on year, which is inseparable from Vietnam’s 40 million game players.

There are many factors that help make Vietnam an attractive market for the game industry. One of them is that the smartphone penetration rate in Vietnam is very high, and more than 50% of the population is using smartphones. The coverage of high-speed Internet, including 4G network, continues to expand, and users can play games anytime and anywhere.

These two years witnessed the rapid development of Vietnam’s mobile game market, and the number of game downloads has reached the top ten in the world. Among the top ten game publishers in Australia, New Zealand and Southeast Asia, Vietnam has five, namely, Amanotes, Onesoft, Gamejam, VNG and Arasol. It is worth noting that in terms of downloads, three of the top 10 tool publishers in Southeast Asia are from Vietnam, including Record&Smart Apps, VNG and LuuTinh.

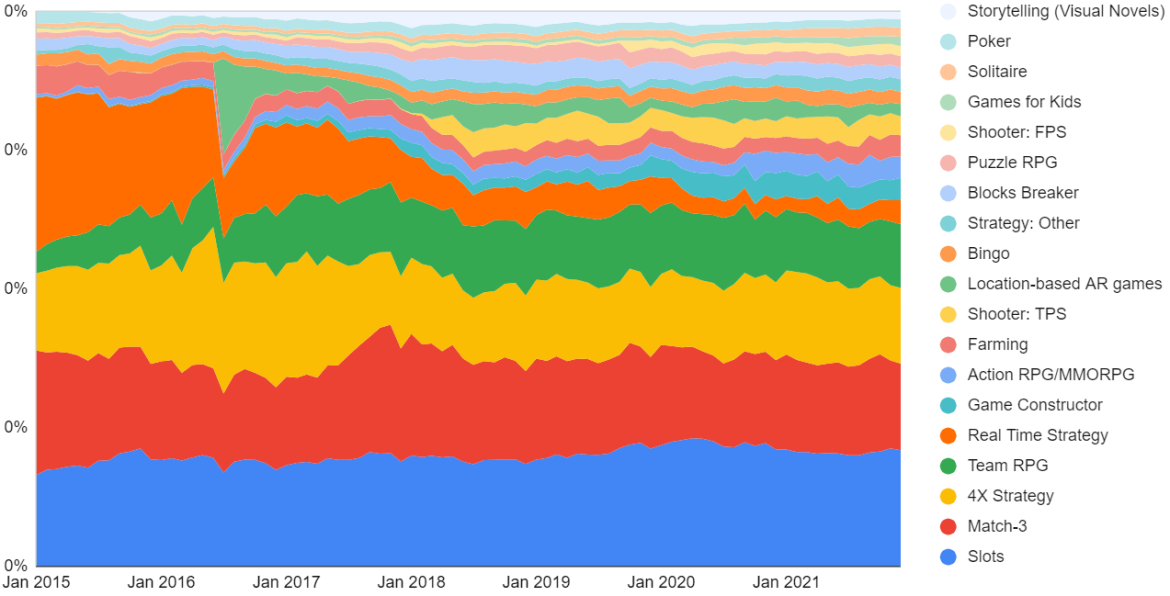

Mobile Games Categories and Main Publishers

According to SensorTower data, MMORPG mobile games are the main game category released in Vietnam, accounting for 52.4%, followed by cards. This shows that Vietnamese users prefer MMO type games. In addition, RPG and other new game types are attracting a large number of Vietnamese.

Mobile or PC games with martial arts and chivalry IP are favored by most gamers in Vietnam, which can be found in the success of Võ Lâm Truyền Kỳ Mobile. Published in 2005 in Vietnam, the game swiftly occupies 70% market share in mobile games, breaking a record. All these factors lead Võ Lâm Truyền Kỳ Mobile to be the largest online game IP in Vietnam.

Võ Lâm Truyền Kỳ Mobile can be found in Redfinger APP Store, which gains popularity for users to employ Redfinger cloud phone to enjoy as well. As a virtual Android system, “Redfinger” allows you to have another Android phone on one device. Running on an ECS, “Redfinger” hardly consumes your own device’s data, storage and battery power. With Redfinger, you can freely run your game on the cloud 24 * 7. In addition, with a Redfinger account, you can manage as many cloud phones as possible to meet your multitasking needs.

In addition to martial arts IP, card games are also rising in Vietnam, such as Genshin Impact and Honkai Impact. According to App Annie data, Vietnamese players will spend money on such games, accounting for about 575% of their total mobile game consumption.

VNG has successfully launched such popular products as Võ Lâm Truyền Kỳ Mobile and PUBG in Vietnam. VNG’s 2020 financial report shows that VNG’s revenue in the game field in 2020 will reach 262 million dollars, accounting for 79.2% of the company’s total revenue.

As the top-notch martial arts IP in Vietnam, Võ Lâm Truyền Kỳ Mobile has achieved a ceiling level of monthly flow. This game was released in 2016, and its monthly traffic reached a peak of nearly 10 million dollars. In the first year of release, players downloaded about 3 million times. Today, Võ Lâm Truyền Kỳ Mobile is still in the top 5 in revenue.

As a new publisher in Vietnam, Funtap has made a series of achievements, namely, it had 100000 dau at the initial release, with an average monthly flow of more than 1 million dollars. In addition to local publishers, there are also Chinese publishers who have solved the intractable problems of royalty amount, payment and promotion in recent years, and successfully established themselves in Vietnam.

Payment Method in Vietnam

At present, the penetration rate of credit cards in Vietnam is only about 5%, because local players have been accustomed to using third-party payment. The most common third-party recharge method in Vietnam is WAP (web app purchase), accounting for 98%. After entering WAP, players can enter the official website for recharging through the FanPage, website and customer service guide of the game. In the specific recharge process, mobile payment, phone bill recharge, game card and online banking are the main channels for Vietnamese players to complete third-party payment.

The five major Internet banks in Vietnam are Yuetong Bank, Techcom Bank, Yuetong Bank, BIDV and VIB. In terms of mobile payment, the most mainstream mobile payment in Vietnam is MoMo, Zalo Pay, and Vietnam Pay. Among them, Momo is the free wallet application with the largest number of users in Vietnam, equivalent to Alipay in China; The number of users of Zalo Pay is growing rapidly, and it is also one of the most popular electronic payment methods in Vietnam; The Yuetong Payment launched in 2018 comes from Yuetong Communication, which has more than 20 million registered users.

Vietnam has three major telecom operators, namely, Vietnam, Mobifone and Vinaphone. Recharge is also widely used in Vietnam. The main game cards are Zing card, Garena card, Vcoin card, Gate card, SohaCoin card, Appota card, etc.

E-banking is the lowest cost channel, less than 5%. However, due to the complexity of the online payment process of local bank cards, the adoption rate of Visa cards in Vietnam is very low.

Vietnam has three major telecom operators, including Vietnam, Mobifone and Vinaphone. Mobile phone charging is also widely used in Vietnam. The main game cards are Zing Card, Garena Card, Vcoin, Gate Card, SohaCoin, Appota Card, etc.

E-banking is the cheapest channel, less than 5%. However, due to the complexity of the online payment process of local bank cards, the adoption rate of Visa cards in Vietnam is very low.